WISO Gehalt – Brutto Netto

Description of WISO Gehalt – Brutto Netto

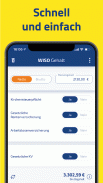

Calculate your net salary and see exactly what you have left of your gross salary. With WISO salary you are perfectly prepared for your next salary discussion or when changing jobs.

WISO Salary calculates the deduction of taxes and social security contributions for the years 2021 to 2024 to the nearest cent.

It's that easy:

Just a few pieces of information are enough: You enter your gross salary, select your tax class, state your year of birth and federal state - and whether you pay church tax. Then, if necessary, select additional points that concern you.

In addition to the tax tables applicable for the corresponding year, many special features are taken into account so that your salary is determined correctly:

• Tax class, with factor for class IV

• Child allowances, children in social security

• Income tax allowances, e.g. for commuting to work

• Health, pension and unemployment insurance

• Own contributions to private health insurance

• Additional contributions to health insurance

• Mini and midi jobs according to the new legal situation

• Age relief amount

• Church tax

Your salary is calculated and displayed on an ongoing basis. You can immediately see how your entries affect gross and net. For example, you can quickly and easily determine what the benefits of changing your tax class are. You can send or print your results directly from the salary app.

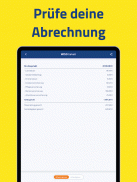

Where is my money going?

WISO Salary not only tells you what is left over net, but also how much of your salary you have to pay for what each month:

• Income tax

• Solidarity surcharge

• Church tax

• Healthcare

• Pension and unemployment insurance

In addition, the salary calculator shows you what the employer actually has to pay for your gross salary.

Use WISO Salary anytime and anywhere – even without an internet connection!

DISCLAIMER

Buhl Data Service GmbH is not a state institution and has no direct connection to the government. The information for the calculations can be found on this official website https://www.bundesfinanzministerium.de/Web/DE/Themen/steuern/steuerarten/Lohnsteuer/Programm Flowplan/programm Flow Plan.html.